When launching a new business, using your personal credit card to fund business expenses is a common practice. However, if you plan on growing the business, potentially hiring employees or expect to need a greater line of credit or a loan in the future, a business credit card may better be suited for your company.

Even if you don’t anticipate those situations happening anytime soon, business credit cards offer different perks that may better align with your business needs and goals.

Moreover, business credit cards can be used to help raise capital that is much needed to grow your business. According to a study conducted by the U.S. Small Business Administration, Office of Advocacy, 7% of small business owners use a business credit card for startup financing.

Having a business credit card and a personal credit card is key to keeping your business and personal finances separate.

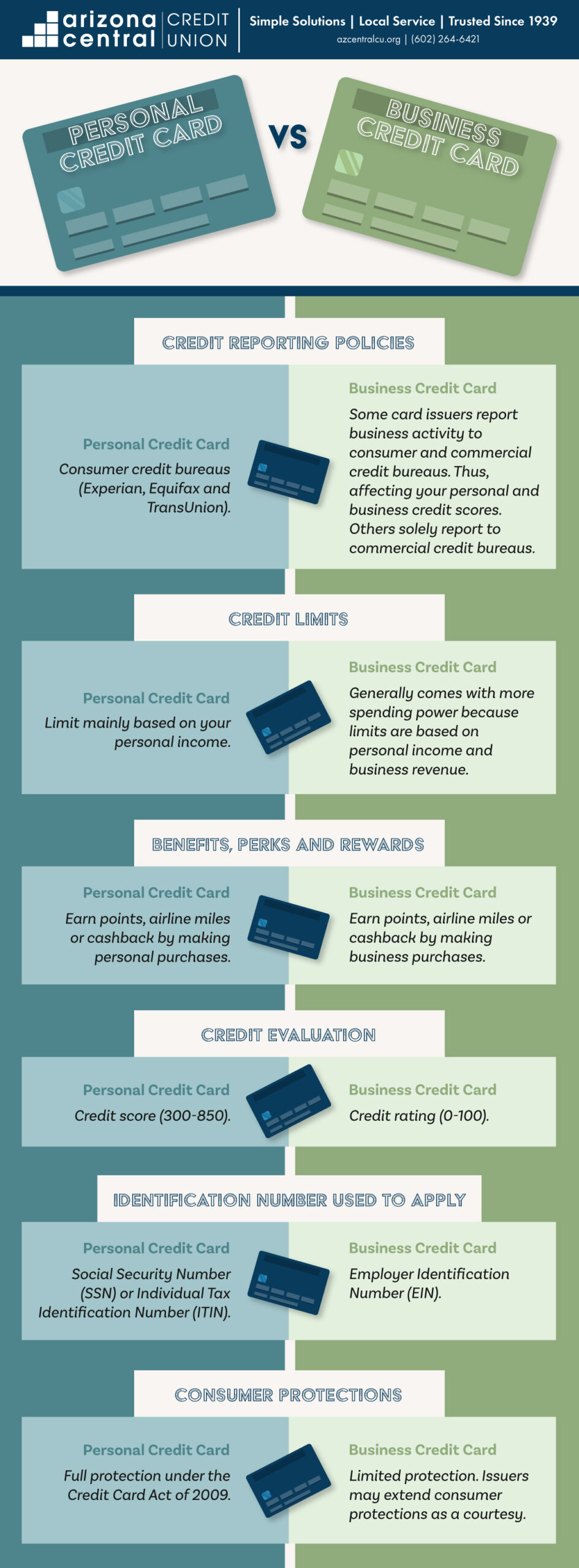

The following infographic will outline the key differences between a personal credit card and a business credit card. We’ll highlight the benefits of each to help you determine which one aligns with your specific financial goals.

Personal Credit Card Vs. Business Credit Card: What’s The Difference? [Content]

A personal credit card and a business credit card come with advantages and disadvantages. Let’s delve into the specifics of both to help you determine which one is right for you.

Business vs. personal credit card: Credit reporting policies

- Personal credit card: Consumer credit bureaus (Experian, Equifax and TransUnion).

- Business credit card: Some card issuers report business activity to consumer and commercial credit bureaus. Thus, affecting your personal and business credit scores. Others solely report to commercial credit bureaus.

Personal vs. business credit card: Credit limit

- Personal credit card: Limit mainly based on your personal income.

- Business credit card: Generally comes with more spending power because limits are based on personal income and business revenue.

Business vs. personal credit card: Benefits, perks and rewards

- Personal credit card: Earn points, airline miles or cash back by making personal purchases.

- Business credit card: Earn points, airline miles or cash back by making business purchases.

Personal vs. business credit card: Credit evaluation

- Personal credit card: Credit score (300-850).

- Business credit card: Credit rating (0-100).

Business vs. personal credit card: Identification number used to apply

- Personal credit card: Social Security Number (SSN) or Individual Tax Identification Number (ITIN).

- Business credit card: Employer Identification Number (EIN).

Personal vs. business credit card: Consumer protections

- Personal credit card: Full protection under the Credit Card Act of 2009.

- Business credit card: Limited protection. Issuers may extend consumer protections as a courtesy.

Bank With Arizona Central Credit Union

No matter the size of your business, it’s important to keep your personal and business finances separate. If you’re in the market for a low-interest rate business credit card, consider a bank with Arizona Central Credit Union. Browse our Business Credit Card page for additional information on our products.

Want additional information? Contact us via telephone or submit a contact form, and a representative will be in touch.