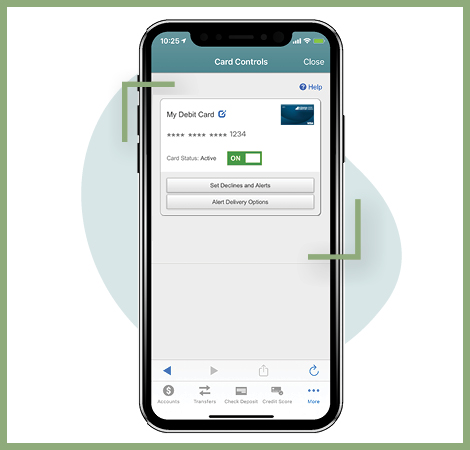

Card Controls

If you have never lost a wallet you are very lucky! But in the event that it does happen (or for those of us that regularly misplace things) our new card controls feature is a life saver! Having a wallet with your ID, cash and cards stolen can be a stressful experience, but Arizona Central has the tools to cover you just in case. Integrated right into our mobile app, you’ll find a section called “Card Controls”. There you can turn your card on and off, and even set limits on what your card can be used for.

Questions? Read our FAQs for additional information.

What else can it do?

Card controls provide real time alerts which can tell you when a particular card is used, and for what. This can help deter fraud by letting you know if someone is trying to use your card without authorization as soon as the transaction happens, enabling you to turn off the card immediately so no other fraudulent transactions are approved. That’s not all! You can even set it to monitor certain cards or transactions, giving you ultimate control over your card and your account.