Managing your finances efficiently is not just a luxury but a necessity. With the advent of technology, mobile banking has emerged as a game-changer, offering unmatched convenience and flexibility in handling your finances.

Whether you’re on a busy schedule, traveling, or simply prefer the ease of accessing your accounts anytime, anywhere, mobile banking is the solution you need.

Embracing the Power of Mobile Banking

Mobile banking allows you to carry out a host of financial tasks directly from your smartphone or tablet. From checking your account balances to transferring funds, paying bills, and even depositing checks remotely, the possibilities are endless. Here’s why mobile banking has become an indispensable tool for individuals and businesses alike:

Convenience at your fingertips

Gone are the days of visiting brick-and-mortar branches or waiting in long lines. With mobile banking, all your financial needs are just a tap away. Whether you’re at home, in the office, or on the go, you can effortlessly manage your money with ease.

Real-time account management

Mobile banking provides instant access to your account information, allowing you to monitor your balances, track transactions, and stay updated on your financial health in real-time. This level of transparency empowers you to make informed decisions and stay in control of your finances.

Effortless transactions

Need to transfer money to a friend, pay a bill, or split expenses? Mobile banking simplifies these tasks with seamless transaction capabilities. Whether it’s transferring funds between accounts or sending money to external recipients, you can complete transactions swiftly and securely, without any hassle.

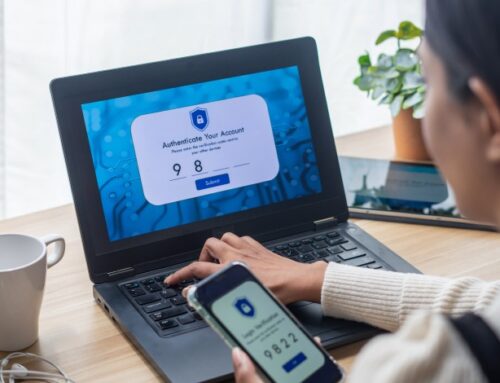

Enhanced security measures

Concerned about the security of your financial data? Mobile banking employs advanced encryption technologies and multi-factor authentication to safeguard your information. With features like fingerprint or facial recognition, you can ensure that only you have access to your accounts, providing peace of mind against unauthorized access.

Remote check deposits

Say goodbye to trips to the bank just to deposit a check. Many mobile banking apps now offer remote check deposit functionality, allowing you to simply snap a photo of the check and submit it electronically. This not only saves you time but also eliminates the risk of losing or misplacing paper checks.

Arizona Central Credit Union offers a number of mobile banking services, such as:

- Check current rates

- Check your balances and transaction history

- Conveniently submit a transaction dispute form

- Deposit checks directly into your account with Mobile Deposit

- Keep up with your money with MX Money Management

- Locate the nearest branch or ATM

- Pay bills on the spot

- Transfer funds between eligible accounts

- View eStatements

Register as an eBRANCH online banking user to take advantage of these services in our convenient app.

Tips for Maximizing Your Mobile Banking Experience

Mobile banking offers unparalleled convenience and flexibility, but to make the most out of this powerful tool, here are some practical tips to optimize your experience:

Enable notifications

Stay informed and in control by enabling push notifications for your mobile banking app. Receive alerts for account activities, such as large transactions, low balances, or suspicious activity, ensuring that you’re always aware of what’s happening with your finances in real-time.

Monitor your accounts regularly

Make it a habit to regularly review your account transactions and balances within the mobile banking app. By staying vigilant, you can quickly detect any unauthorized or suspicious activity and take immediate action to protect your accounts from fraud or identity theft.

Set up alerts and reminders

Customize your mobile banking app to send you alerts and reminders for important financial tasks, such as bill due dates, account overdrafts, or upcoming payments. This proactive approach helps you stay organized and avoid missing deadlines or incurring unnecessary fees.

Use budgeting tools

Many mobile banking apps offer built-in budgeting tools and spending trackers to help you manage your finances more effectively. Take advantage of these features to set budget goals, track your expenses, and identify areas where you can save money or cut back on spending.

Explore additional features

Beyond basic banking transactions, explore the full range of features and functionalities offered by your mobile banking app. This may include mobile check deposit, person-to-person payments, account linking, or even investment management tools. Familiarize yourself with these capabilities to unlock the full potential of your mobile banking experience.

Arizona Central Credit Union offers convenient money management with ZelleⓇ, an app connected to your account, letting you send and receive money easily. That’s only one additional feature we can offer you.

Stay educated on security best practices

Protect your financial information and personal data by adhering to security best practices recommended by your bank or financial institution. This may include setting strong, unique passwords, enabling biometric authentication, avoiding public Wi-Fi networks for sensitive transactions, and regularly updating your mobile banking app to the latest version.

Review privacy settings

Take a moment to review and adjust the privacy settings within your mobile banking app to suit your preferences. Consider opting out of data-sharing agreements or adjusting location tracking settings to maintain greater control over your personal information and privacy.

Keep your app updated

Regularly updating your mobile banking app is crucial for ensuring optimal performance, security, and access to the latest features. By keeping your app updated, you not only benefit from improved stability and performance but also stay protected against potential security vulnerabilities and threats.

Bank When You Want With Arizona Central Credit Union

Mobile banking is revolutionizing the way we manage our finances, offering unparalleled convenience, flexibility, and security. By harnessing the power of mobile technology, you can take control of your financial life like never before.

At Arizona Central Credit Union, we can make your banking experience more convenient with online and mobile services that will help you achieve your financial goals. Explore our wide variety of checking and savings account options. If you have any questions about opening an account, contact us online or call (866) 264-6421.