If you often reach the end of the month with little left to save, or you’re struggling to set aside money for bigger goals like a home down payment or retirement, a budgeting method can provide structure. A budget gives your dollars direction; it helps you monitor where your money goes so you can make intentional choices and reach your financial milestones.

There are many budgeting methods out there. Some are straightforward and easy to follow; others offer detailed control. Here are several popular approaches and tips for how to choose one that suits your lifestyle.

Why Budgeting Matters

Budgeting empowers you to:

- Track spending patterns and identify areas for improvement.

- Set realistic expectations for bills, savings, and discretionary spending.

- Plan ahead for short-term needs and long-term goals.

- Make financial decisions with clarity and confidence.

A thoughtful budgeting practice creates financial awareness that helps you stay in control of your money.

Popular Budgeting Methods in 2026

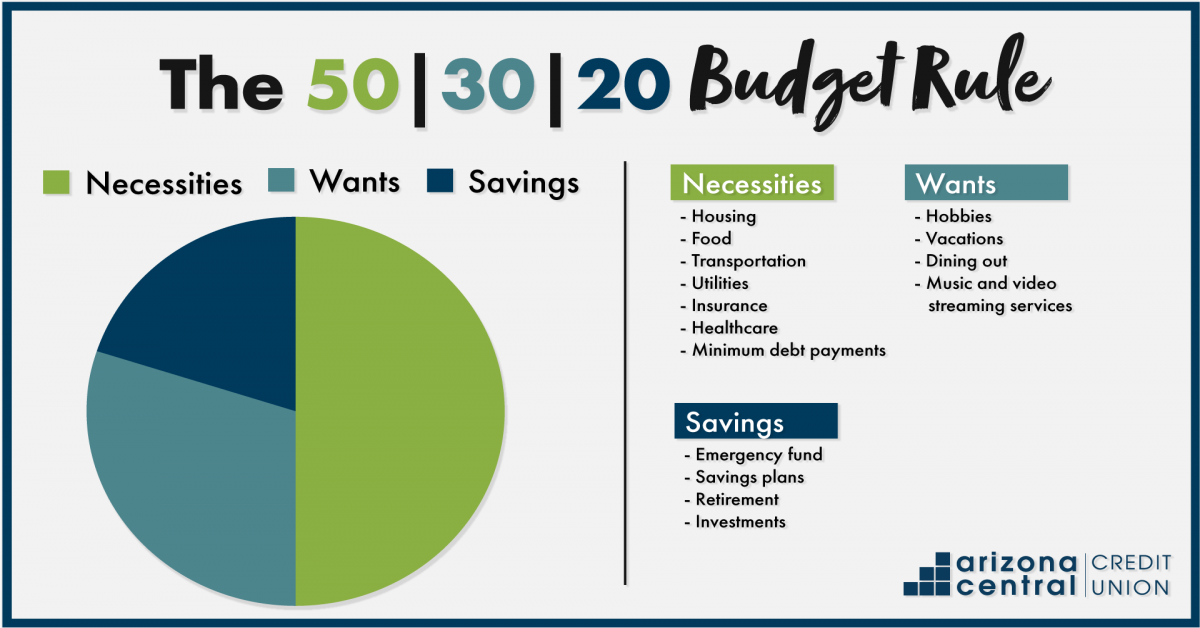

1. 50/30/20 rule

The classic 50/30/20 framework splits income into three main buckets:

- 50% for needs like housing, utilities, groceries, insurance, and transportation.

- 30% for wants such as entertainment, dining out, and travel.

- 20% for savings and debt repayment.

This method is easy for beginners and keeps your budget simple and balanced.

Best for: People who want a straightforward, big-picture approach.

[/fusion_text]

2. 60/30/10 rule

With rising costs of living in many areas, financial professionals are increasingly recommending a 60/30/10 split:

- 60% for essentials,

- 30% for discretionary spending,

- 10% for savings or additional debt reduction.

This updated structure reflects the reality that necessities often consume more than half of many budgets today.

Best for: Individuals in higher-cost regions or those prioritizing flexibility.

3. Zero-based budgeting

With zero-based budgeting, every dollar is assigned a purpose before the month begins. Whether it goes toward bills, groceries, savings, or fun, your income minus your planned spending equals zero at the end.

This approach requires detail and discipline; you must track every expense.

Best for: People who want total visibility and control over their money.

4. Envelope budgeting (cash stuffing)

The envelope budgeting method visually allocates money into physical or digital “envelopes” for categories like gas, groceries, and dining out. Once the dollars in an envelope are spent, that category stops for the month.

The resurgence of this method — often called “cash stuffing” — reflects a desire for tangible control over spending behaviors.

Best for: Anyone who wants strict boundaries for variable spending.

5. Line-item budget

Here you create a detailed list of all expected expenses in a spreadsheet or budgeting tool. You can also use budgeting calculators to compare projected costs to actual spending so you can adjust and stay informed.

Best for: People who like data and want fine-grained tracking.

6. Pay-yourself-first strategy

Instead of budgeting what you plan to spend, this method prioritizes savings first. You designate a savings amount at the start of the month, then plan your expenses around what remains.

Best for: Savers and goal-focused individuals.

7. Proportional budgeting

You divide income into categories with percentages that match your personal priorities rather than fixed rules. For example, you might choose to allocate 15% to savings, 35% to essentials, and 50% across variable categories.

This method offers flexibility and can be customized as goals evolve.

Best for: People who want the freedom to change their budgeting goals.

8. Hybrid and goal-based methods

Many people blend techniques to fit their lifestyle; for example, combining the discipline of zero-based budgeting with the flexibility of proportional budgeting. Some modern frameworks also focus on goals first, tying every dollar to specific milestones like emergency funds, travel, or home ownership.

Best for: Experienced budgeters or those with complex financial objectives.

Tools to Support Your Budget

AZCCU offers free personal finance management tools in your online banking experience. These tools can help you:

- Automatically categorize expenses,

- Track spending trends,

- Set and monitor budgets by category,

- Create goals for savings or debt payoff,

- Review your overall financial picture.

With insights built into your workflow, you can budget smarter without extra effort.

How to Choose the Right Method

- Match your personality: Simple rules work well for some; detailed plans work better for others.

- Consider your goals: Are you building savings, reducing debt, or planning for a big event?

- Be flexible: You can experiment and pivot to another approach as your life or priorities change.

AZCCU Can Help You Budget

There is no one “perfect” budgeting method for everyone. What matters most is choosing an approach you can stick with consistently, that helps you stay mindful of how you use your money, and that supports your short- and long-term objectives.

Once you find a method that resonates, review it regularly and adjust as needed. A budget isn’t static; it should grow with your lifestyle.

For more financial insights, tools, and guides, visit AZCCU’s Budgeting Resources. You can also contact AZCCU online or call (866) 264-6421.